Investors seeking a steady stream of income and potential for long-term growth often turn to dividend-paying stocks. One popular exchange-traded fund (ETF) that offers exposure to a portfolio of dividend-paying stocks is the Schwab U.S. Dividend Equity ETF (SCHD). In this article, we'll delve into the details of SCHD, exploring its investment strategy, performance, and benefits, as well as its ranking on

Zacks.com.

Investment Strategy

The Schwab U.S. Dividend Equity ETF (SCHD) is designed to track the Dow Jones U.S. Dividend 100 Index, which comprises 100 high-dividend-yielding stocks traded on U.S. exchanges. The index is weighted by dividend yield, with the highest-yielding stocks receiving the largest weights. This approach allows SCHD to focus on companies with a history of paying consistent dividends, potentially providing investors with a relatively stable source of income.

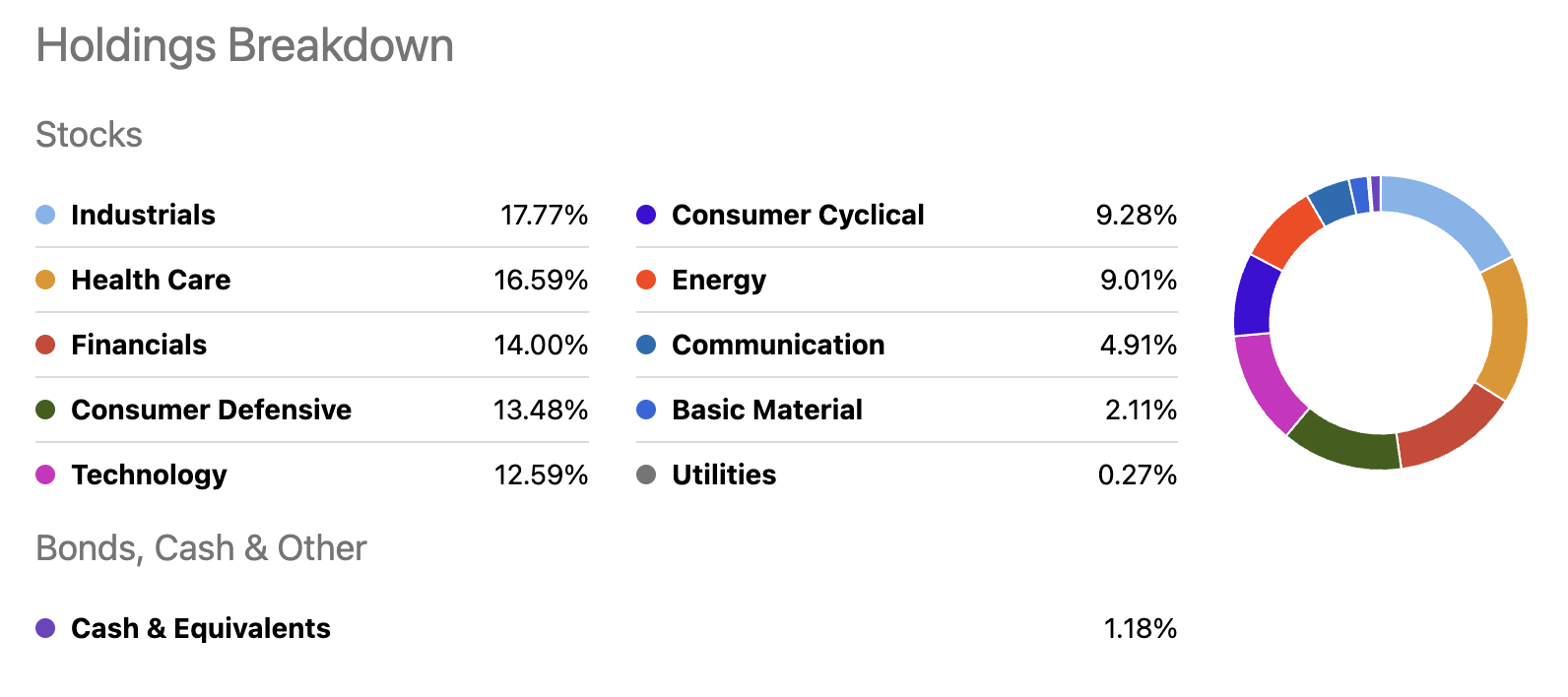

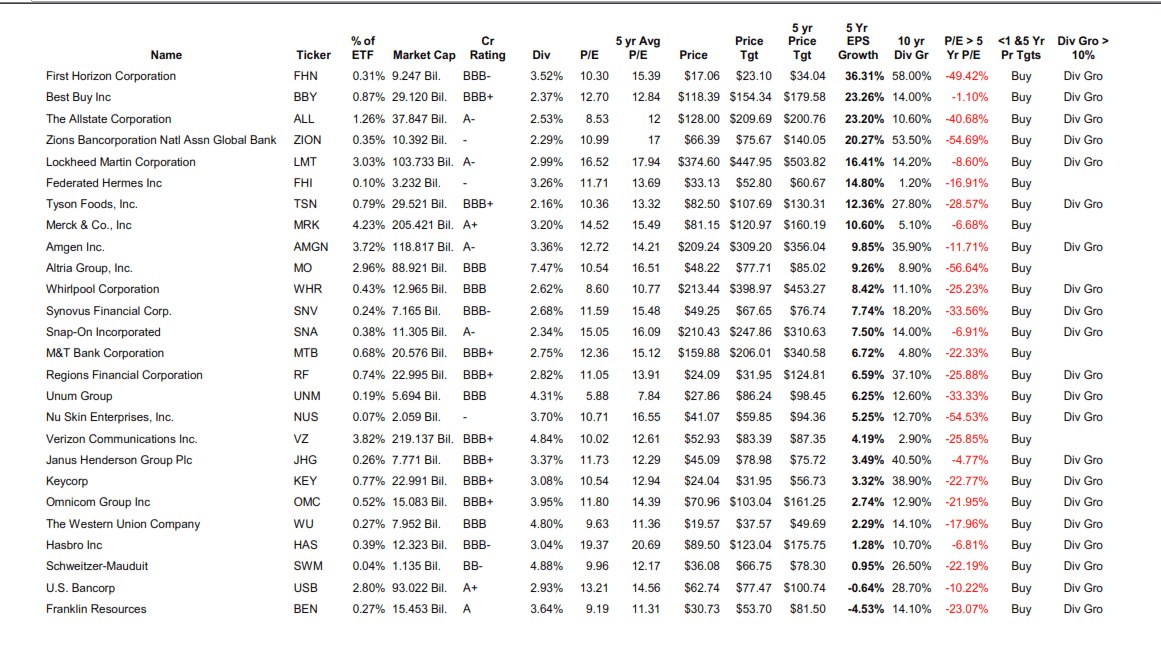

Holdings and Sector Allocation

SCHD's portfolio consists of a diverse range of dividend-paying stocks across various sectors, including consumer staples, industrials, healthcare, and financials. The fund's top holdings include well-known companies such as

Procter & Gamble,

Cisco Systems, and

3M. The fund's sector allocation is designed to provide broad diversification, reducing exposure to any one particular industry or market segment.

Performance and Fees

SCHD has consistently delivered strong performance, with a trailing 12-month yield of 2.92% and a 5-year average annual return of 10.34%. The fund's low net expense ratio of 0.06% makes it an attractive option for cost-conscious investors. According to

Zacks.com, SCHD has a Zacks ETF Rank of 2 (Buy), indicating its strong potential for outperformance.

Benefits for Investors

The Schwab U.S. Dividend Equity ETF (SCHD) offers several benefits for investors, including:

Regular Income: SCHD's focus on dividend-paying stocks provides a potential source of regular income, which can help investors meet their income needs or reinvest dividends to grow their portfolio.

Diversification: The fund's broad portfolio and sector allocation help reduce exposure to individual stock risk, making it a more stable investment option.

Low Costs: SCHD's low expense ratio makes it an attractive option for investors seeking to minimize fees and maximize returns.

The Schwab U.S. Dividend Equity ETF (SCHD) is a popular choice among investors seeking a diversified portfolio of dividend-paying stocks. With its strong performance, low fees, and potential for regular income, SCHD is an attractive option for those looking to unlock the potential of dividend investing. As always, investors should consult with a financial advisor and conduct their own research before making investment decisions. For more information on SCHD and other ETFs, visit

Zacks.com today.

Note: This article is for informational purposes only and should not be considered as investment advice.